CelestLoan is the first decentralized finance protocol in the Celestia public chain ecosystem that provides users with flexible staking and lending tools based on TIA tokens. The platform allows users to stake TIA through simple on-chain operations and mint cTIA on a 1:1 ratio, offering nearly 17% staking returns. cTIA is not only a certificate of holding TIA in the ecosystem but also allows flexible interactions with external lending protocols and trading products, capturing no-loss earning opportunities on the chain.

CelestLoan will officially launch on January 8 at 8 PM (UTC+8), marking the entrance into a new phase. CelestLoan aims to provide users with a complete financial services ecosystem.

Core Features of CelestLoan Platform

– Based on $TIA: CelestLoan is an innovative decentralized staking and lending protocol centered around the Celestia token $TIA, providing flexible staking and lending tools for users.

– Diversified Earning Paths: Users can stake $TIA, mint cTIA at a 1:1 ratio, enjoy staking rewards, airdrop points, and other earnings. They can also borrow USDT based on cTIA, significantly enhancing asset liquidity.

– Annual Yield: Staking TIA to obtain cTIA allows users to enjoy a 17% annual yield.

– Collateral Lending: Collateralize cTIA to borrow USDT (60% collateralization rate).

– Minting Points: Minting cTIA earns minting points (1:1 exchange for minting points) for future benefits.

High-Level Security

In DeFi projects, security is crucial. CelestLoan has undergone multiple contract audits (e.g., MetaTrust) and counters common security vulnerabilities (like DDoS attacks, cross-site scripting, SQL injection), ensuring project security. Additionally, a security monitoring system has been established to regularly monitor platform activities, promptly identifying and responding to abnormal behavior and potential attacks.

Operation Mannual

– Users add cTIA assets in their Optimism chain wallet: 0x072F5D8c43ee7580FBCab88a880ff0c08dFd6531 (smart contract address).

– Transfer TIA tokens to a Cosmos ecosystem wallet, such as Keplr. Visit the CelestLoan official website, access the staking interface, and link the Keplr wallet (note: select the Celestia chain).

– Enter the staking amount and choose the receiving wallet address for cTIA on the Optimism chain.

– After completing the staking, cTIA assets can be viewed in the Optimism wallet address.

CelestLoan Launch and User Incentive Carnival

Upon its launch, CelestLoan will initiate a mystery boxes airdrop carnival. Users holding cTIA can receive box airdrops and earn lucky points by opening them. The platform tallies user cTIA holdings every five days, calculating box numbers based on cTIA holdings divided by 100.

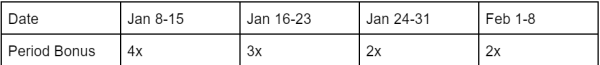

During the first month of launch, from January 8 to February 8, holding cTIA allows participation in box draws, with periodic box bonuses. The bonuses for different periods are as follows:

A single account can receive up to 10 boxes per period before bonuses, with a maximum of 40 blind boxes during the 4x bonus period (e.g., January 8-15).

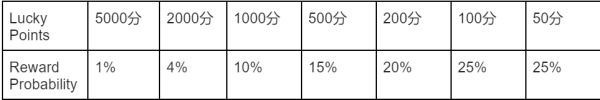

Example: During January 8-15, a user holding 620 cTIA calculates their boxes as 620/100=6.2, therefore receiving 6*4=24 blind boxes. The probability of receiving different lucky points from the blind boxes is as follows:

Further details on the activities will be continuously updated on CelestLoan’s official media platforms.

The launch of CelestLoan’s mainnet not only provides more diverse support to the Celestia chain ecosystem but also marks an important step in the expansion of $TIA derivatives. By offering decentralized staking and lending tools, as well as a focus on security, CelestLoan is dedicated to providing a safe, efficient, and flexible service platform for $TIA derivatives. We invite you to join us on January 8 to witness this significant moment.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: CelestLoan

Contact Person: Dareen Lee

Email: Send Email

Country: Singapore

Website: https://www.celestloan.com/